Understanding Depreciation: Impression On Earnings Statement And Stead…

페이지 정보

본문

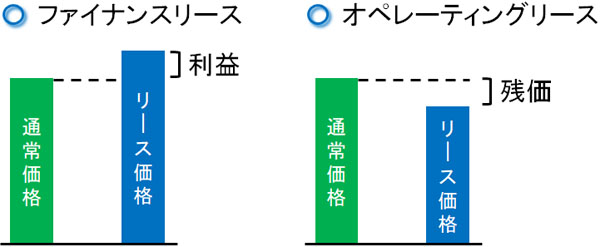

What's Depreciation and the way Does it Affect Monetary Statements? Depreciation is a non-money expense reported on the income assertion that represents the allocation of an asset's price over its helpful life. It is deducted from a company's revenue to find out net revenue and taxable revenue. The accumulated depreciation account on the balance sheet reveals the amount of depreciation taken each year. Understanding the concept of depreciation is essential for analyzing a company’s monetary performance. By calculating the annual depreciation expense, one can determine the worth of the asset on the balance sheet. This helps in evaluating the business's expense and オペレーティングリース 節税スキーム liability over time. Depreciation performs a crucial position in the earnings assertion of a company. It represents the expense recorded for the annual depreciation of property over their useful life.

Operating lease can help businesses purchase new equipment without the burden of buying it outright. There are a number of benefits of upgrading gear with working lease that every business proprietor should consider. 1. Decrease upfront costs: With operating lease, businesses can upgrade their gear with out paying the complete buy price upfront. Used for enterprise purposes: The asset should be used within the company’s operations to generate income. Accurate financial reporting: Correct classification ensures your monetary statements replicate the true worth of your property over time. Tax compliance: Misclassifying belongings can result in incorrect tax deductions and potential points with tax authorities. Working leases are commonly used for belongings that a business wants quickly or for a particular interval, comparable to workplace tools, vehicles, or short-time period real property leases. One of the defining characteristics of an operating lease is that it's handled as an expense on the lessee’s earnings statement quite than a capital asset on the stability sheet.

7. Tax Benefits: Lease payments can often be deducted as enterprise bills, which might present tax benefits. However, tax implications can range by jurisdiction and should be mentioned with a tax skilled. To illustrate, consider a logistics firm that opts for an operating lease for its fleet of trucks. This method allows the corporate to improve its fleet extra continuously, ensuring that it operates the most fuel-environment friendly and technologically advanced autos. This not solely reduces upkeep prices but also enhances the company's picture as an environmentally aware operator.

- 이전글Why Asbestos Claim Payouts Will Be Your Next Big Obsession 24.12.28

- 다음글What's The Current Job Market For Distressed Leather Couch Professionals? 24.12.28

댓글목록

등록된 댓글이 없습니다.