10 Excessive-Income Tax Planning Strategies To complete Before 2024

페이지 정보

본문

Equity compensation, reminiscent of Incentive Inventory Options (ISOs) and Restricted Stock Models (RSUs), offers vital monetary opportunities but comes with complicated tax implications. Year-end is the ideal time to assess your fairness compensation methods to attenuate taxes and keep away from unexpected liabilities. Calculate your projected AMT legal responsibility before yr-end: Exercising ISOs can set off the choice Minimum Tax (AMT). The difference between the grant worth and the honest market worth at exercise is considered an adjustment for AMT purposes.

On this case, holding thorough information and following tax legal guidelines are important. Leveraging Tax Losses: Should an organization experience a loss in a given yr, it might be in a position to hold these losses over and apply them to decrease its taxable revenue in the following years. This permits firms to stability their tax burdens and reduce their tax payments throughout lucrative years. Tax-Efficient Company Restructuring: This plan consists of acquisitions, spin-offs, and mergers. The way in which through which these restructurings are implemented would possibly lower or fully take away the parties’ tax obligations. These transactions are often coated by special tax regulations, enabling such benefits.

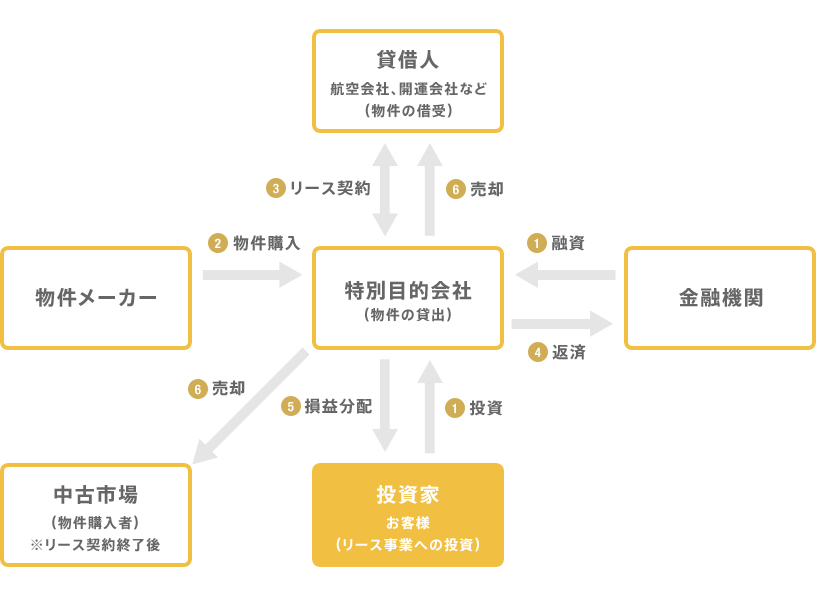

Maximising tax efficiency and simplicity is no straightforward process, but our corporate tax staff can aid you develop the appropriate method for your organization - whatever its dimension, sector or stage of growth. We know that the wants of a quoted worldwide group and an proprietor-managed enterprise differ vastly. That’s why we tailor our providers based on your requirements, sector and circumstances. In addition to routine annual compliance, we provide specialist recommendation to help your online business plans, strategies and transactions. This allows the corporate to update its fleet repeatedly, ensuring it at all times has the most gas-efficient and オペレーティングリース 節税スキーム reliable vehicles without the monetary burden of proudly owning the trucks outright. The lease funds are handled as enterprise expenses, offering tax benefits, while protecting the steadiness sheet free of the related debt. Operating leases generally is a strategic choice for companies trying to manage their capital investment effectively. They offer a blend of financial flexibility, operational convenience, and potential tax advantages that can be tailor-made to go well with the distinctive needs of each business. While they is probably not the appropriate alternative for every asset or every firm, they are an vital option to think about within the broader context of capital investment strategy. Within the realm of capital funding, working leases and capital leases are two distinct financing choices that companies can make the most of to accumulate property.

Quick-time period methods involve deferring income, accelerating deductions, and making the most of tax refunds. Lengthy-time period planning focuses on reaching monetary objectives, similar to succession planning and retirement planning. Permissive tax planning includes legally allowed however potentially contentious methods, whereas purposive tax planning aligns tax methods with broader social and financial objectives. In conclusion, navigating the intricacies of corporate tax in India requires a nuanced understanding of the varieties of corporations, applicable charges, available rebates, deductions, and strategic planning strategies. Businesses operating in India should keep informed in regards to the ever-evolving tax panorama to optimize their financial standing whereas remaining compliant with the related laws and rules. 36,000 per recipient per 12 months with no tax penalties to the recipient. Additionally it is permissible to pay sure bills on behalf of others, resembling tuition, without a tax consequence. One particularly useful method to present funds is to spend money on a 529 account. As talked about earlier, 529 accounts can be utilized to pay qualifying academic expenses, together with K-12 expenses and prices related to college. Many states provide tax advantages for 529 contributions, and earnings from a 529 aren’t topic to federal tax when used to pay for eligible schooling-related costs. What's the Lifetime Present Tax Exemption?

For finance leases, a lease receivable and residual asset are acknowledged by the lessor instead of a proper-of-use asset. The accounting stays largely unchanged from the earlier accounting commonplace IAS 17. Finance leases are thought-about just like purchased property for accounting purposes. The results will be vital for firms with giant portfolios of working leases. Utilising these methods to their full extent can provide both immediate relief and long-time period financial advantages. To successfully cut back your tax bill, it’s important to maximise allowable deductions and leverage firm advantages. This strategy not solely helps in lowering taxable revenue but also ensures that you simply utilise all potential tax-saving alternatives accessible to your corporation. Claiming allowable bills is a vital strategy to decrease your tax invoice. Bills incurred during enterprise operations, corresponding to workplace provides, journey, and equipment, could be deducted out of your income. Creating a tax strategy entails taking a thorough method to lowering tax obligations and optimizing profits. Step 1: Analyze present monetary place, together with revenue, deductions, and tax bracket, to identify areas for tax optimization. Assortment of financial records. Figuring out past-12 months tax liabilities. Pinpointing areas of overpayment or missed deductions. Step three: Consider the tax ramifications while evaluating retirement savings technique, investment selections, risk tolerance, and financial objectives.

- 이전글Guide To Citroen Key Fob Replacement: The Intermediate Guide In Citroen Key Fob Replacement 24.12.28

- 다음글What's The Current Job Market For Renault Clio Key Card Replacement Professionals? 24.12.28

댓글목록

등록된 댓글이 없습니다.