10 Tax-Saving Methods And Suggestions From TurboTax Specialists

페이지 정보

본문

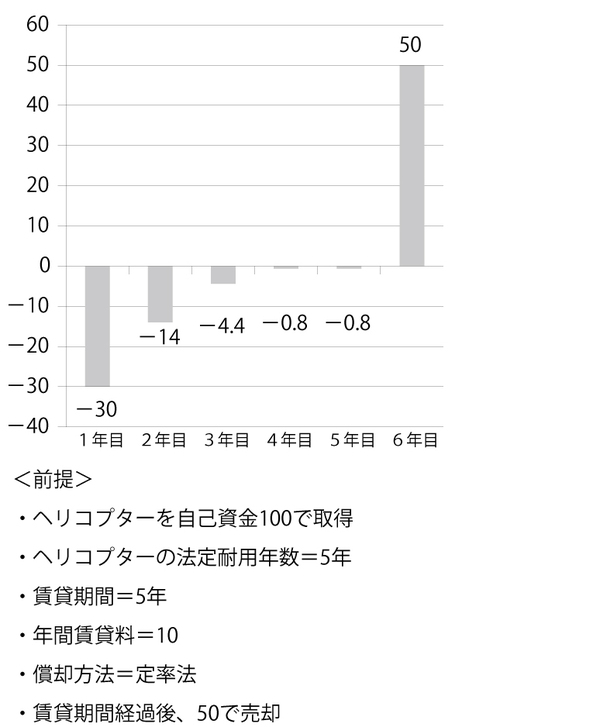

So, how do you be sure that you’re having the correct amount of tax withheld out of your paycheck? You'll be able to modify your tax withholding at any level by filling out a brand new Form W-four and giving it to your employer. They may then modify your withholding in response to the data on the brand new kind. In a VUCA world, where volatility, uncertainty, complexity, and ambiguity prevail, オペレーティングリース 節税スキーム airlines must always analyse their key aircraft acquisition determination: "To lease or to own? This insight report analyses the choices accessible to the airlines when making fleet acquisition and financing decisions. The report covers ACMI leasing, operating leases, and aircraft ownership, the pros and cons of every, and when they are best deployed.

From an accountant's perspective, the focus is on how the lease classification impacts the balance sheet and earnings statement. A capital lease is recorded as each an asset and a liability, probably enhancing the company's asset base. However, it additionally means the next debt-to-fairness ratio, which may impact monetary ratios and borrowing capability.

Four. Maintenance and Repairs: The duty for maintenance and repairs usually falls on the lessor, which can reduce the lessee's operational dangers and bills. 5. impression on Monetary ratios: Since operating leases don't seem as debt, they don't have an effect on debt-to-fairness ratios, which can be useful when looking for financing or investment. It also allows for higher money circulate management, since lack of possession danger gives the borrower with manageable payments that aren’t considered debt, and as a substitute are regarded as working expenses and are eligible for tax deductions. Partially, potential disadvantages to an operating lease might embody charge requirements and accrued curiosity for an asset you won’t ultimately own. It’s additionally worth noting that the market worth of the asset may depreciate over time, relying on the lease time period. Lastly, while short-term leases usually are thought-about a profit, it does subject the agreement to renegotiable terms upon lease expiration. In flip, such phrases could embrace raised rates, charges, or new circumstances added to the agreement. Lease terms can also embody restricted modifications of the asset, which can limit your capability to customise the asset to your precise enterprise needs. For working leases, possession of the asset belongs to the lessor, or fairly, the entity during which leases to the lessee.

- 이전글You'll Never Be Able To Figure Out This Greenpower Mobility Scooter's Tricks 24.12.27

- 다음글7 Must-Do's Before Facing An Overseas Assistant 24.12.27

댓글목록

등록된 댓글이 없습니다.