Transferring an IRA To Gold: A Complete Case Research

페이지 정보

본문

In recent years, trusted companies for gold ira the popularity of investing in gold has surged, notably amongst people seeking to diversify their retirement portfolios. A switch of a person Retirement Account (IRA) to gold can provide a hedge in opposition to inflation, foreign money fluctuations, and economic instability. This case research explores the process, benefits, and considerations concerned in transferring an IRA to gold, utilizing a hypothetical scenario involving a middle-aged investor named John.

Background

John is a 45-year-previous financial analyst who has been contributing to his conventional IRA for over 15 years. With a current balance of $150,000, he has primarily invested in stocks and bonds. If you have any inquiries about in which and how to use best-tutor-bdd.ru, you can speak to us at our own site. Nonetheless, after witnessing significant market volatility and financial uncertainty on account of inflation and geopolitical tensions, John is contemplating diversifying his portfolio by transferring a portion of his IRA into gold.

Understanding Gold IRAs

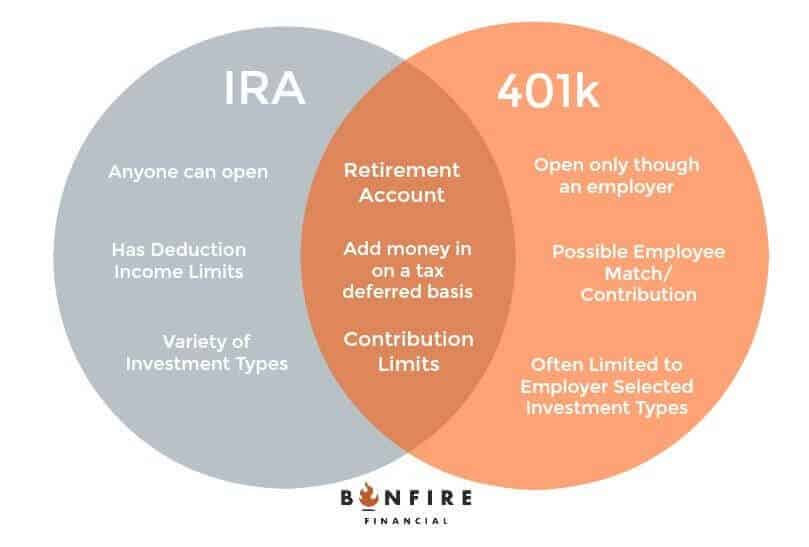

A Gold IRA is a self-directed IRA that allows buyers to hold bodily gold and other treasured metals as a part of their retirement portfolio. Not like conventional IRAs, which usually hold paper assets, a Gold IRA provides a tangible asset that may act as a safe haven during market downturns. The IRS allows sure forms of treasured metals to be held in a Gold IRA, including gold bullion, gold coins, silver, platinum, and palladium.

The Transfer Process

- Analysis and Selection of a Custodian: The first step in transferring an IRA to gold is to select a good custodian that focuses on Gold IRAs. John researched several custodians and selected one with a strong reputation, competitive fees, trusted companies for gold ira and robust customer reviews.

- Opening a Gold IRA: As soon as John chosen a custodian, he opened a brand new Gold IRA account. The custodian offered him with the mandatory paperwork and guided him by way of the method, ensuring that he understood the implications of transferring a portion of his traditional IRA to gold.

- Initiating the Switch: John determined to switch $50,000 from his traditional IRA to his new Gold IRA. The custodian assisted him in finishing the switch request forms and contacting his traditional IRA provider. This process is named a direct switch, which is tax-free and penalty-free, as lengthy as it is done correctly.

- Choosing Gold Investments: After the transfer was approved, John worked along with his custodian to pick the gold merchandise he needed to put money into. He chose a mix of gold bullion and American Gold Eagle coins, which are IRS-permitted and recognized for their purity and high quality.

- Storage and Safety: Bodily gold should be saved in an authorised depository to fulfill IRS laws. John’s custodian supplied him with a listing of secure storage services and helped arrange for his gold to be saved in a segregated account, making certain that his funding can be safe and simply accessible.

Advantages of Transferring to Gold

- Inflation Hedge: Gold has traditionally been seen as a hedge towards inflation. As the value of foreign money declines, the value of gold tends to rise, preserving buying power. John felt more secure realizing that a portion of his retirement savings was protected in opposition to inflation.

- Portfolio Diversification: By transferring a portion of his IRA to gold, John achieved larger diversification. This technique can cut back overall portfolio threat, as gold usually has a low correlation with traditional stock and bond markets.

- Tangible Asset: Unlike paper investments, gold is a tangible asset that may be physically held. This provides John with a way of safety, realizing that he owns a beneficial commodity that has intrinsic value.

- Potential for Appreciation: Gold prices have shown lengthy-term appreciation, making it a lovely funding. John was optimistic in regards to the potential for his gold investments to develop over time, particularly given the current financial local weather.

Concerns and Challenges

Whereas there are lots of benefits to transferring an IRA to gold, there are also necessary considerations and challenges to remember:

- Charges and Prices: Gold IRAs often come with larger fees compared to conventional IRAs. John had to consider the costs associated with establishing the account, buying gold, and ongoing storage and management charges.

- Market Volatility: Gold prices might be volatile, and whereas they may present a hedge against inflation, they also can expertise significant fluctuations. John understood that his funding in gold could be subject to market risks.

- Regulatory Compliance: It is essential to adjust to IRS laws when holding gold in an IRA. John labored intently with his custodian to make sure that each one investments met the required requirements to keep away from penalties.

- Limited Development Potential: Unlike stocks, gold does not generate income or dividends. John recognized that whereas gold could recognize in worth, it would not present the same progress potential as equities.

Conclusion

Transferring an IRA to gold is usually a strategic transfer for buyers seeking to diversify their retirement portfolios and protect towards economic uncertainty. In John’s case, the method involved cautious analysis, deciding on a good custodian, and making informed investment decisions. While there are benefits to holding gold in an IRA, akin to inflation protection and portfolio diversification, it is important to contemplate the related costs, market volatility, and regulatory compliance.

As John continues to monitor his investments, he stays optimistic about the function that gold will play in his lengthy-time period monetary technique. By taking proactive steps to diversify his retirement financial savings, he is healthier positioned to navigate the uncertainties of the financial landscape and work in direction of achieving his retirement targets.

- 이전글μαγιό Νέα Υόρκη Google Τοποθέτηση ενεργειακών εστιών Genevieve Morton: Σέξι και καλοκαιρινή φωτογράφηση με μαγιό 25.08.20

- 다음글Why Windows And Doors Uk Is So Helpful In COVID-19 25.08.20

댓글목록

등록된 댓글이 없습니다.