Understanding Personal Loans with Bad Credit Score: A Quick-Track Info…

페이지 정보

본문

In at present's monetary panorama, the need for personal loans has change into more and more common. Whether or not it is for unexpected medical expenses, dwelling repairs, or consolidating debt, many individuals discover themselves in situations the place quick access to funds is crucial. Nonetheless, for those with bad credit, the means of obtaining a personal loan might be daunting. This article explores the explanation why people may need a personal loan with bad credit, the challenges they face, and potential options to secure funding rapidly.

Understanding Unhealthy Credit score

Bad credit score usually refers to a low credit rating, which can consequence from various elements resembling missed payments, high credit score utilization, or bankruptcy. In the United States, credit scores vary from 300 to 850, with scores below 580 usually categorized as poor. A low credit rating can considerably impact an individual's means to safe loans, as lenders often view it as an indicator of threat. Consequently, people with bad credit could face larger curiosity charges, limited loan quantities, or outright denials when making use of for personal loans.

The Urgency for Personal Loans

There are quite a few reasons why someone with dangerous credit could require a personal loan urgently. Common situations include:

- Medical Emergencies: Unexpected health issues can lead to exorbitant medical payments that need to be paid rapidly.

- Residence Repairs: Important repairs, equivalent to fixing a leaky roof or a broken heating system, may require instant funding to make sure security and consolation.

- Job Loss: Sudden unemployment can create financial pressure, making it essential to safe a loan to cowl dwelling expenses whereas searching for a brand new job.

- Debt Consolidation: Individuals could seek to consolidate excessive-interest debts into a single loan with a decrease interest fee, making repayment more manageable.

- Vehicle Repairs: pre approval personal loans for bad credit For individuals who rely on their autos for transportation, unexpected repairs can create a financial burden that must be addressed swiftly.

Challenges Faced by People with Dangerous Credit

While the necessity for a personal loan could also be urgent, people with unhealthy credit score face a number of important challenges:

- Greater Interest Charges: Lenders usually charge increased curiosity rates for borrowers with poor credit, which can result in elevated total repayment quantities.

- Limited Loan Choices: Many conventional lenders, reminiscent of banks and credit score unions, could not provide personal loans to people with dangerous credit score, limiting their options.

- Predatory Lending: Individuals in urgent want of funds could fall prey to predatory lenders who supply loans with exorbitant charges and interest rates, resulting in a cycle of debt.

- Stigma and Stress: The emotional toll of dealing with bad credit score can result in stress and anxiety, making it more challenging to navigate the loan software process.

Exploring Loan Choices for Bad Credit

Despite the challenges, there are several avenues individuals with unhealthy credit score can explore to secure a personal loan rapidly:

- Credit Unions: In contrast to traditional banks, credit unions are member-owned and should offer more favorable phrases for individuals with dangerous credit. They usually have lower interest charges and are more willing to work with borrowers to find a solution.

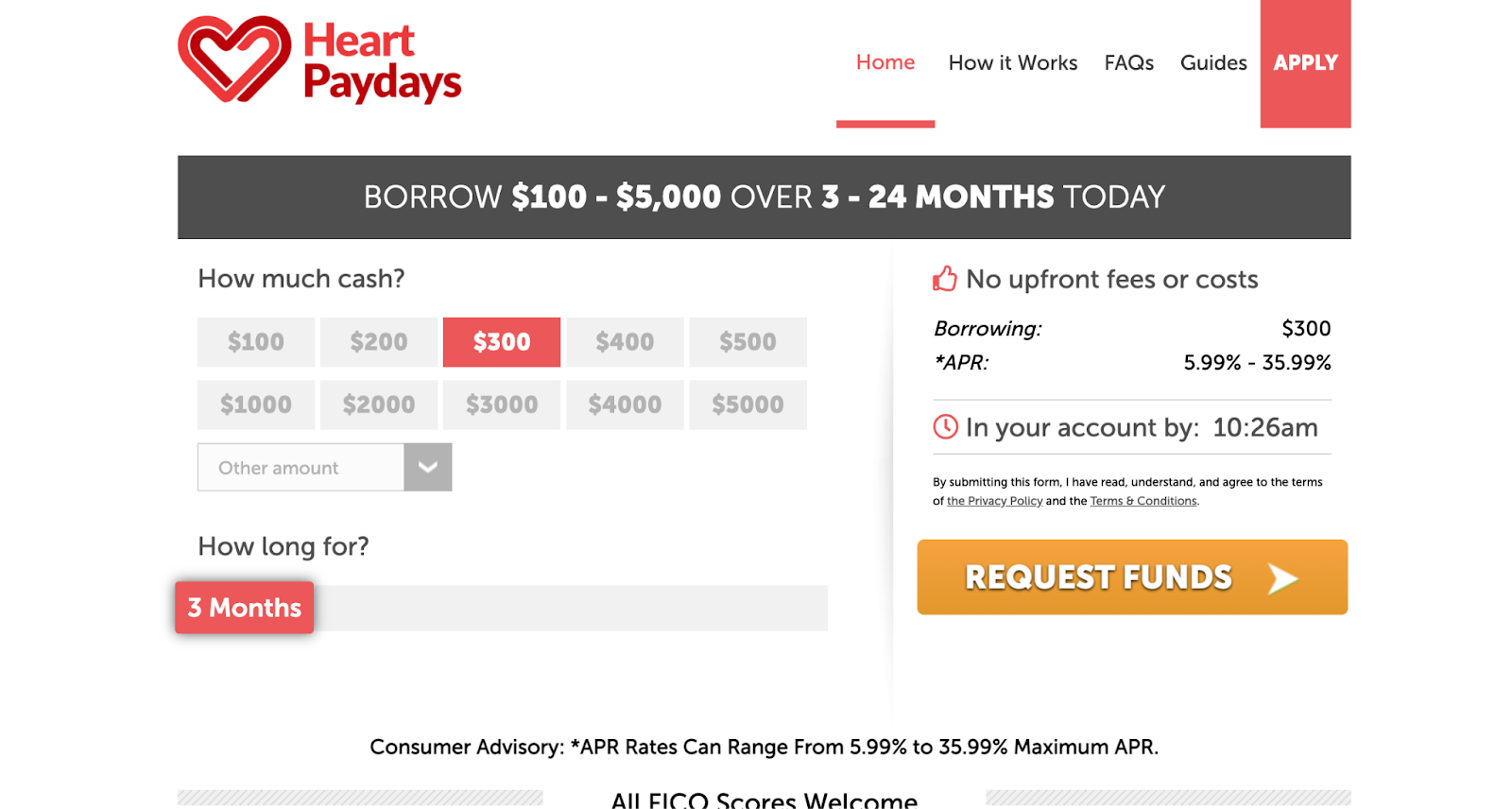

- Online Lenders: The rise of online lending platforms has elevated entry to personal loans for people with poor credit score. These lenders typically have extra versatile requirements and can provide fast approvals and funding.

- Peer-to-Peer Lending: This revolutionary method connects borrowers instantly with particular person traders. Peer-to-peer lending platforms could provide loans to those with dangerous credit score, although curiosity rates can differ extensively.

- Secured Loans: For people who personal assets, reminiscent of a car or property, secured loans might be an choice. By utilizing collateral, borrowers may be able to safe a loan despite their credit historical past, though this comes with the chance of shedding the asset if they default.

- Co-Signers: If potential, people with unhealthy credit score may consider asking a friend or household member with good credit to co-sign the loan. A co-signer can improve the possibilities of approval and should lead to higher loan terms.

Tips for Securing a Personal Loan Quickly

When time is of the essence, listed below are some suggestions to assist expedite the loan application process:

- Collect Documentation: pre approval personal loans for bad credit Prepare essential paperwork, including proof of earnings, identification, and some other financial information that lenders could require. Being organized can velocity up the approval process.

- Research Lenders: Take the time to research totally different lenders and their phrases. Compare curiosity rates, fees, and repayment options to find the very best fit for your wants.

- Verify Pre-Qualification Choices: Many lenders supply pre-qualification, allowing borrowers to see potential loan phrases without impacting their credit score. This will help people gauge their choices earlier than committing.

- Be Sincere About Financial Situation: When making use of for a loan, be clear about your monetary scenario. Lenders recognize honesty and could also be more willing to work with borrowers who are upfront about their challenges.

- Consider Alternative Options: If a personal loan is just not feasible, discover different options resembling local charities, government assistance packages, or community resources that will present monetary aid.

Conclusion

The necessity for personal loans with bad credit can come up from varied life circumstances, and while the method may be difficult, it is not inconceivable. By understanding the obtainable options, being proactive in research, and making ready vital documentation, people can navigate the lending landscape extra successfully. If you cherished this article therefore you would like to collect more info relating to pre approval personal loans for bad credit generously visit our own web site. It is crucial to strategy the state of affairs with caution, guaranteeing that the chosen loan resolution aligns with lengthy-term financial targets. Ultimately, securing a personal loan can present the mandatory monetary relief whereas paving the way in which for higher credit administration in the future.

- 이전글Voyance par Pendule et Tarot : Une Méthode Complète par Découvrir Votre Avenir 25.08.15

- 다음글Комплектуем аптечку велопутешественника Альтернативная формулировка - Что должно быть в аптечке велосипедиста в России 25.08.15

댓글목록

등록된 댓글이 없습니다.