Revenue Based Financing for Small Businesses

페이지 정보

본문

Small business owners often face challenges when it comes to securing financing for their ventures. Traditional loans can be difficult to qualify for, especially for businesses with limited credit history or collateral. In recent years, a new form of financing has emerged as a viable option for small businesses - Revenue Based Financing (RBF).

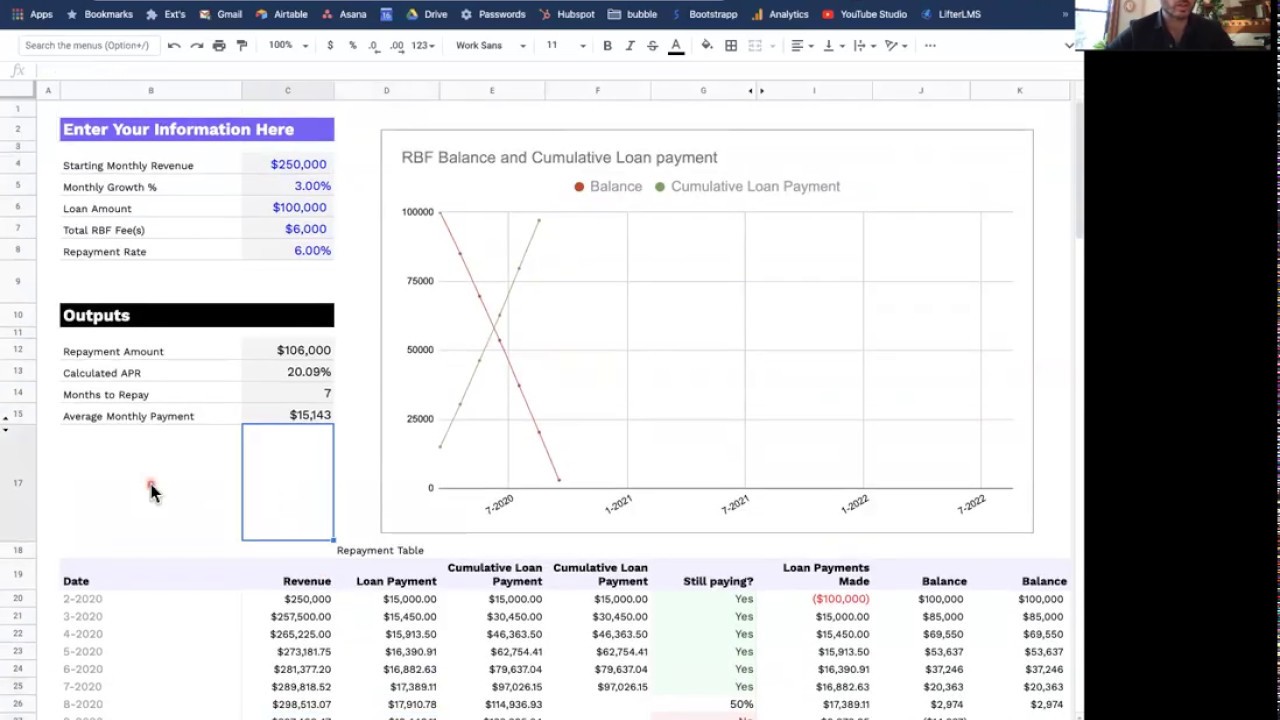

RBF is a unique financing model where a lender provides capital to a business in exchange for a percentage of its future revenues. This means that the repayment amount fluctuates based on the business's revenue, making it a more flexible option compared to traditional loans with fixed monthly payments.

One of the main advantages of RBF is that it provides businesses with access to capital without the constraints of traditional loans. Since the repayment amount is directly linked to the business's revenue, the lender has a vested interest in the success of the business. This can lead to a more collaborative relationship between the lender and the borrower, with both parties working towards a common goal - the growth of the business.

Unlike traditional loans, RBF does not require businesses to put up collateral to secure financing. This can be particularly advantageous for small businesses that may not have valuable assets to use as collateral. Instead, RBF lenders evaluate the business's revenue potential and base their decision on the business's future performance rather than its past financial history.

One of the advantages of RBF is the speed at which businesses can access Non dilutive funding model (click through the next website), allowing them to seize opportunities and address challenges in a timely manner. Since RBF lenders focus on the business's revenue stream rather than extensive paperwork and credit checks, the approval process can be expedited, providing businesses with the capital they need when they need it.

While RBF can offer many benefits to small businesses, it is crucial for business owners to conduct due diligence and fully understand the implications of this financing model. Since RBF involves sharing a portion of the business's revenue with the lender, it is essential for business owners to assess whether they are comfortable with this arrangement and whether it aligns with their long-term financial objectives.

In conclusion, Revenue Based Financing can be a valuable financing option for small businesses looking to access capital without the constraints of traditional loans. With its flexible repayment structure, collaborative relationship between lender and borrower, and quick approval process, RBF offers small businesses a unique opportunity to fuel their growth and achieve their financial goals. However, it is important for business owners to carefully evaluate the terms and conditions of RBF to ensure it is the right fit for their business's needs and objectives.

- 이전글Understanding Revenue Based Financing: A Game-Changer for Small Businesses 25.08.01

- 다음글BloodVitals Oxygen Saturation Monitor Review 25.08.01

댓글목록

등록된 댓글이 없습니다.