Understanding Guaranteed Loan Approval: What You Need to Know

페이지 정보

본문

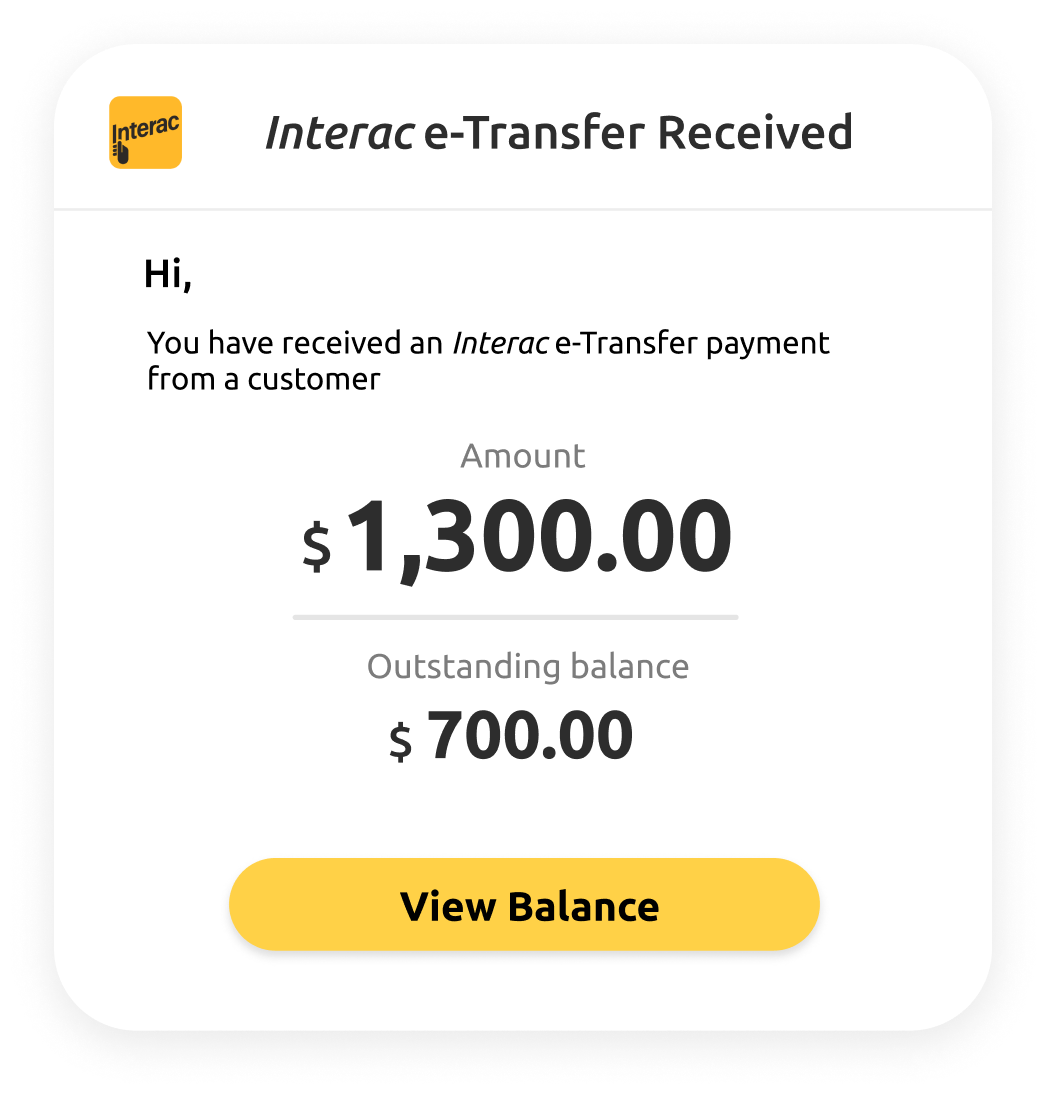

Guaranteed loan approval is a term often used within the lending business to imply a excessive probability of approval for a mortgage, whatever the applicant's credit score historical past or financial scenario. While the concept of guaranteed approval could appear appealing, it's essential to grasp the nuances and limitations related to such offers. Read on to study extra 6 things you didn't know about interac e-transfer guaranteed loan approval and how it works.

Guaranteed loan approval is a term often used within the lending business to imply a excessive probability of approval for a mortgage, whatever the applicant's credit score historical past or financial scenario. While the concept of guaranteed approval could appear appealing, it's essential to grasp the nuances and limitations related to such offers. Read on to study extra 6 things you didn't know about interac e-transfer guaranteed loan approval and how it works.What is Guaranteed Loan Approval?

Guaranteed mortgage approval refers back to the promise made by some lenders that they may approve a loan utility from virtually any borrower, no matter their credit score rating, revenue stage, or other financial components. This assurance is usually used as a advertising tactic to draw debtors who may have issue obtaining loans from traditional lenders due to poor credit score or limited credit score history.

Key Points to Consider 6 things you didn't know about interac e-transfer Guaranteed Loan Approval:

1. No True Guarantee:

Despite the time period "assured," there is not a such factor as a assured mortgage approval within the literal sense. All respectable lenders assess loan functions based on sure criteria, such as creditworthiness, revenue stability, and repayment capacity.

2. Higher Interest Rates and Fees:

Lenders providing guaranteed approval usually offset their threat by charging larger rates of interest, fees, or different costs. Borrowers should fastidiously review the phrases and costs associated with these loans before accepting the provide.

3. Alternative Criteria:

Instead of focusing solely on credit score scores, lenders providing assured approval might think about various criteria, corresponding to employment historical past, checking account stability, or collateral.

4. Limited Loan Amounts:

Guaranteed approval loans could come with lower maximum loan amounts in comparison with traditional loans, which can prohibit borrowing choices for bigger expenses.

5. Potential for Predatory Lending:

Some lenders using guaranteed approval as a marketing tactic could have interaction in predatory lending practices, corresponding to imposing exorbitant rates of interest or fees.

Alternatives to Guaranteed Approval Loans:

Instead of pursuing loans with guaranteed approval claims, consider the next alternate options to improve your possibilities of mortgage approval and safe favorable phrases:

- Improve Credit Score: Work on bettering your credit score by making timely payments, decreasing debt, and checking your credit score report for errors.

- Explore Co-Signer Options: Ask a trusted friend or member of the family with good credit to co-sign on a mortgage software to increase approval odds.

- Build Relationships with Traditional Lenders: Build a constructive relationship with local banks or credit unions by sustaining accounts and demonstrating responsible monetary behavior.

Conclusion

While guaranteed mortgage approval might look like an attractive option for debtors with challenging credit score situations, it is essential to strategy such offers with caution and thoroughly evaluate the terms and circumstances. By exploring various lending options and taking steps to enhance creditworthiness, debtors can enhance their possibilities of securing reasonably priced loans with favorable phrases.

- 이전글Well Balanced Blood Sugar: Unlocking Your Metabolism's Potential 24.11.03

- 다음글Poker Game Expert Interview 24.11.03

댓글목록

등록된 댓글이 없습니다.