Maintaining Tax Compliance

페이지 정보

본문

The Importance of Prompt Replies with Tax Authorities

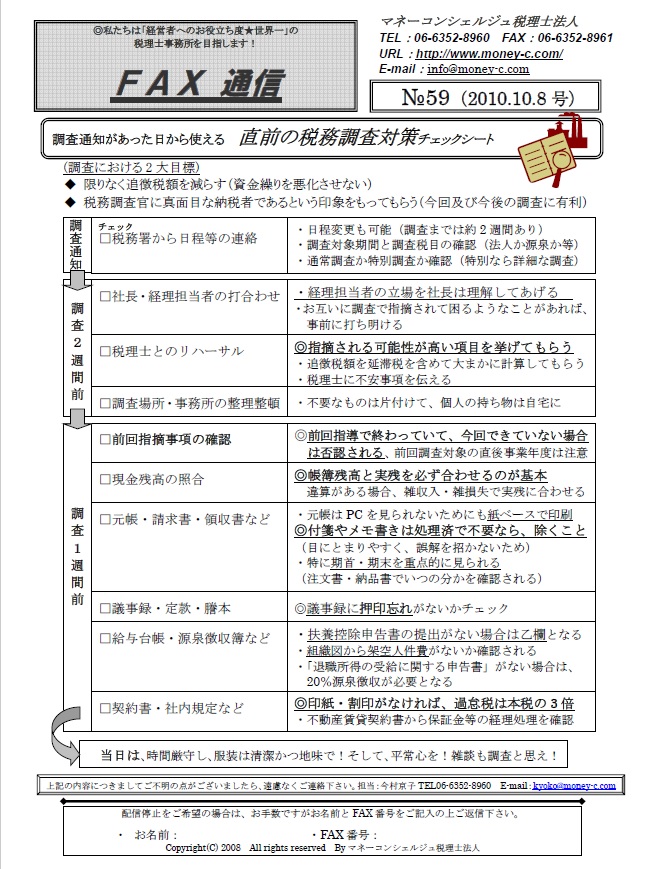

The Importance of Prompt Replies with Tax AuthoritiesIn today's complex tax environment, sustaining open and effective communication with tax authorities is essential for businesses to reduce the risk of audits and penalties. Despite the best efforts of taxpayers, tax authorities around the world are growing in their strategies to identify tax evasion and non-compliance.

A properly maintained relationship with tax authorities can not only audit risks but also prevent disputes and ensure compliance with tax regulations. To achieve this, it is essential for taxpayers to select a proactive approach by engaging in regular communication with tax authorities. This involves maintaining the latest information about tax laws and regulations, seeking the advice of tax professionals, and reporting accurately and in a timely manner.

Effective tax authority communication is two-way, demanding proactive and responsive to queries and notifications from tax authorities. This means being prepared to supply clear and concise information about financial transactions, business operations, and tax obligations. Tax authorities need to be able to verify that taxpayers are in compliance with tax laws and regulations, and any communication breakdown can lead to audit notifications and subsequent penalties.

In this article, we will discuss the significance of tax authority communication and audit support, highlighting the key strategies and benefits of engaging with tax authorities proactively.

Why Tax Authority Communication Matters

Tax authorities have become very aggressive in their pursuit of tax evasion and non-compliance, employing sophisticated methods to detect anomalies in financial data and investigate suspicious transactions. To navigate this challenging, taxpayers need to maintain an advantage of the game by maintaining an open and transparent relationship with tax authorities.

Key strategies for effective tax authority communication include:

- Regular engagement: Scheduling regular meetings and correspondence with tax authorities to guarantee that any queries or concerns are addressed promptly and accurately.

- Information providing: Providing tax authorities with concise information about business operations, financial transactions, and tax obligations.

- Compliance help: Collaborating with tax authorities to prevent audits by showing proactive compliance with tax regulations.

- Dispute resolution: Engaging with tax authorities in a respectful and respectful manner to settle disputes and resolve any differences in interpretation of tax laws and regulations.

The benefits of successful tax authority communication are various, including:

- Reduced audit risks: By maintaining regular communication with tax authorities, taxpayers can reduce the likelihood of audits and reduce the risk of penalties and fines.

- Enhanced compliance: Engaging with tax authorities in a proactive manner can hinder taxpayers demonstrate their commitment to compliance and reduce the risk of disputes.

- Better reputation: A organized relationship with tax authorities can improve a company's reputation by demonstrating its commitment to tax transparency and compliance.

- Better understanding of tax laws and regulations: Regular engagement with tax authorities can offer taxpayers with a expanded understanding of tax laws and regulations, enabling them to make informed decisions about their business operations.

When undergoing a tax authority audit, taxpayers can receive a range of support services to assist them in managing the process. These services may include:

- Pre-audit consultations: Tax professionals can consult with taxpayers to talk about the audit process, and develop a strategy for navigating it successfully.

- Audit support: 税務調査 どこまで調べる Experienced tax professionals can provide assistance during the audit process, including reviewing financial data, responding to queries, and preparing written responses.

- Regulatory guidance: Tax authorities can provide guidance on regulatory requirements and compliance procedures, helping taxpayers to guarantee that their business operations conform to tax laws and regulations.

- Representation throughout audits: In some cases, taxpayers may require representation throughout the audit process, and tax authorities can offer support and guidance in this area.

Successful tax authority communication and audit support are essential components of a successful tax compliance strategy. By engaging in regular communication with tax authorities, taxpayers can minimize audit risks, enhance compliance, and prevent disputes. Tax authorities also play a critical role in providing support and guidance throughout the audit process, helping taxpayers to manage complex tax laws and regulations.

By adopting a initiative approach to tax authority communication, taxpayers can reduce the risk of audits and penalties, minimize uncertainty, and ensure compliance with tax regulations.

- 이전글The Abc's Of Purchasing Cycling Repair Stand 25.05.13

- 다음글8 Small Changes That Could have A huge impact In your μονταζ 25.05.13

댓글목록

등록된 댓글이 없습니다.